Many hotels are experiencing a notable increase in bookings coming from online travel agencies, most notably those from Booking.com.

At the same time, direct bookings, those generated from a hotels own website, are declining in both absolute and relative terms when compared to what OTAs generate.

And it makes no sense to believe that most OTAs outsell hotels and increase their total sales volume, based only on what is described as an unfair breach of the rate parity clause.

If this were true, cases like Booking.com would be inexplicable given that the selling prices on these websites are managed by the hotels themselves.

Be the first to know, sign up here and stay up to date with our latest revenue management news, updates and special offers

This begs the question, why has a solution not been found to this unbalanced brokerage in this age of the internet?

Despite the common belief that tourists prefer to book their hotel directly and that the intermediary Booking.com and its peers add little value for the customer, the facts alone speak for themselves.

Not only are OTAs dominating in the arena of sales against direct bookings through hotel websites, they are also becoming the preferred reservation method for tourists, most notably when up against small chains and individual hotels.

According to a recent report from Google, The 2014 Traveler’s Road to Decision, 50% of corporate tourists prefer to book through a travel agency with approximately 33% of leisure tourists opting for the same.

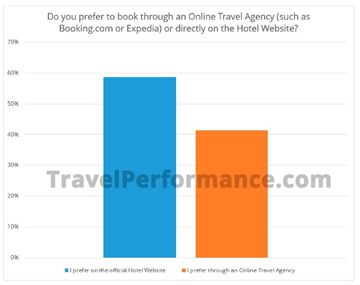

To understand the enormity of this phenomenon, I want to share with you a snippet from a market study carried out by my consulting company.

As the diagrams show, direct booking through hotel websites seems to be the preferable option for tourists, however that preference changes dramatically when customer age is taken into account.

In the first diagram, we see that when booking on line 41% of tourists prefer to do so through OTAs like Booking.com and Expedia.

In the following diagram we see that once age is accounted for, 50% of people aged between 35 and 44 prefer to reserve through OTAs.

This age segment is not mere casual information, but should be seen as the principal focus point for OTAs overall for its importance in volume of bookingsand the segments purchasing power.

It would be very interesting to debate the results provided above but in order to elaborate further we would need to include additional variables, such as socio-demographics etc.

However, the message is clear: online travel agencies are, year on year, increasing their customer base as much as their volume of business.

It is important to highlight that this trend is not experienced by all online travel agencies in equal measure, as Booking.com and Expedia’s customer base completely overshadows that of other OTAs.

What are OTAs doing better than hoteliers in order to get more sales?

For the purpose of this post, an exhaustive analysis is not possible. Therefore, we will only take into consideration some of the more relevant tactics.

The two main tactics that OTAs have adopted to achieve their success over hotels are:

- Winning New Customers Maintaining active clients, or those who were once active.

Key factors in winning new customers

The most influential factors when choosing a website or provider to purchase a travel itinerary and other tourist services according to a PhocusWright report are:

1) Family/Friend recommendations (word of mouth on positive experiences)

Building on this, a study by the New York Times provides an analysis of those factors that push people to recommend online services and/or products and lists them as:

- To promote valuable content and enrich people’s lives

- To define ourselves (how we view the world and what we care about)

- To maintain, improve and nurture our relationships

- For self-fulfilment

- To get the word out about causes we care about

It is clear that if the OTAs are managing to awaken any of these stimuli within the user/customer/tourist, it is because they are doing a good job…

And for example, if no friends or family are interested in sharing their positive experiences of webs such as Expedia, then the OTA can introduce a ‘social proof’ that serves as a reference for other potential users.

2) Personalized offers and recommendation tailored by the OTA

On Booking.com, everything is designed to advise and focus (or divert, as appropriate…) the customer at all times. See some examples highlighted in red in the picture below.

However, the personalisation of results and suggestions, that are very common in tourist websites, is still in a state of development.

To better understand the client’s intention to purchase, it is not only necessary to collect and analyse huge amounts of data (big data) but also to collect users’ private information in order to feed the algorithms that are becoming more and more sophisticated.

For years, giants like Google and Amazon have been implementing technology to gather the important data used to characterise and personalise an offer.

The ultimate goal is to reduce the number of offers proposed to customers and, at the same time, increase their relevancy. Subsequently, the clients enjoy a better consumer experience, resulting in a higher conversion rate for the organisation.

Therefore, it is easy to foresee that the final battle for the client, between OTAs and hotels, will be fought – in the most part – within the capacity to understand and personalise the web experience for each customer.

What is more, the fact that OTA giants have begun to recruit specialists to interpret user data, known as “Data Scientists”, reinforces this vision.

The personalisation and tailoring of huge amounts of data, concerning the behaviour and desires of clients, has also given way to advancement in Customer Loyalty Programs. However, to store and use personal data, the authorisation of the customer is required.

3) First Time Buyer Offers

In the above image we see an example of how Expedia, through the use of their mobile application, publish coupons to encourage the first purchase.

More generic discounts, with fewer or no restrictions, also tend to act as ‘first purchase’ offers. Most people do not repeatedly buy trips within a short time-frame so that the “loyalty effect” of such discounts (as they often soon expire) is usually limited.

What is more, for small OTAs, where the rate of repeat purchase is even smaller, discounts without restrictions are even more important to win new customers.

4) The Power of Positive Reviews

Although sometimes they may promote biased opinions, articles appearing in newspapers, television reports, etc., can reach a wider audience, and finally work!

Of course, the more “authentic” opinions tend to be more effective however they are the hardest to obtain.

5) Search Engine Optimisation

The big OTAs invest enormous amounts of money on Google Adwords in order to position themselves in a prime position on the results pages of a travel-related search.

Online marketing campaigns, centred on the creation and promotion of brand notoriety, as well as sales oriented campaigns, are optimised by the OTAs to achieve the lowest cost to booking ratio possible.

To achieve a positive return on investment that guarantees the profitability of the OTAs operations, the company realises many activities to generate synergies between acquiring the customer and the experience of that same customer/user once they have entered the website.

The optimisation of the landing pages, use of dynamic pages and prospecting and remarketing techniques are all part of the optimisation strategy.

Cost optimisation is essential for the profitability of OTAs

To achieve economic sustainability in a situation where the costs of marketing (for example the cost of a Google click) are increasing, it is indispensable to create economies of scale regarding these incurred costs and generally reduce the weight of paid campaigns per reservation.

Moreover, the exact same marketing costs are also rising for hotels trying to promote their own website. Finally, searches for key words like ‘hotels in Rome’ (where costs are almost prohibitive) have become the battleground of a few large players.

The principal OTAs have, in the majority of cases, also overtaken the Hoteliers website regarding quality and quantity of content, for example in the detailed descriptions and photos of the hotel, doorstep amenities and attractions beyond, – guides, maps, reviews – the list is endless.

This has been done through major investment, to not only improve in terms of SEO (optimization of organic positioning) and get the best positions in Google natural results (“free of charges”), but also to enhance the website experience for their customers.

Until recently it was very difficult for a hotel to publish its ‘Guest Book’ comments. This applies specifically to hotel chains, where because of branding issues, or internal “political” problems, took too long to adopt this type of transparency.

Thus hoteliers let OTAs, often in collaboration with Tripadvisor, achieve the image of transparent sellers.

This is how they have gained the trust of millions of tourists online.

Looking ahead

With the emergence of P2P customer reviews, the OTAs have managed to give even more complete information, a better customer experience and get extra differential content (texts).

This in turn has helped them improve their organic rankings on Google, reaching positions in many cases above official hotel websites even for brand hotel searches (To see the magnitude of this you must also look at the results for a Spanish hotel indifferent international domains of Google, like www.google.ru for example.).

Moreover, the metasearch websites have allowed the possibility for increased visibility and popularity for the big OTAs as well as the less recognised, who apply generous discounts to the price of hotels in order to “promote themselves” as the cheapest channel for hotel booking.

When all is said and done, could they do better?

I don’t think so. So hats off!

NB2: This is an analysis by Francesco Canzoniere, ex-CEO of Viajar and now founder and managing director of Travel Performance. It was written to coincide with the first IT Travel Madrid event with Enterprise Ireland in October 2014.