Table of Contents

- 1 Revenue Management 101 “5 easy steps to successful Revenue Management for midscale and limited service hotels”

- 1.1 What is Revenue Management?

- 1.2 Main indexes used in the Revenue Management science

- 1.3 It can be calculated in a few different ways:

- 1.4 = ADR x Occupancy

- 1.5 There is one more index, more accurate and objective:

- 1.6 5 easy steps to successful Revenue Management

- 1.7 STEP1: Dynamic pricing

- 1.8 And the key points to remember are the following:

- 1.9 STEP 2: Setting stay restrictions

- 1.10 STEP 3: Managing booking channels

- 1.11 How it works:

- 1.12 STEP 4: Overselling

- 1.13 STEP 5: Managing group and corporate business

- 1.14 Managing online reviews

- 1.15 Upgrading

- 1.16 Managing room Type differentials

- 1.17 Managing ancillary revenues

- 1.18 All of the above (and more), nicely organized in 2 strategic blocks

- 1.19 Strong demand tactics (work hard, capitalize on ADR!)

- 1.20 Automation in Revenue Management

- 1.21 Benefits of an automated Revenue Management System:

Revenue Management 101 “5 easy steps to successful Revenue Management for midscale and limited service hotels”

What is Revenue Management?

Why revenue needs to be managed? The answer is obvious: to increase profits. Unfortunately, not all hotel operators understand the importance of managing revenue and paying enough attention to this activity. In most cases, they simply underestimate the ROI associated with it. Many of them are still concentrated on the more conservative approach of managing just the expense side of the operations while ignoring the revenue side.

However, times have changed. Today, dynamic hospitality market presents a high level of uncertainty:

- How strong will the demand be on any given day in the future?

- What price expectations will those customers have?

- What will competitors implement today, tomorrow and every day in the future?

- How will future events affect revenues (for example, economic situation, changes in gas prices or air fares, construction next door)?

Besides, now customers are equipped with a wide range of tools that help them navigate in the market of hotel rooms and find deals that don’t always contribute to the hotels’ revenue growth (i.e. numerous OTA and aggregator websites, allowing customers to compare room rates, discounted opaque websites, mobile apps, etc.).

Be the first to know, sign up here and stay up to date with our latest revenue management news, updates and special offers

Times of “set it and forget it” are long gone. In order to be able to respond to this challenge and not get lost in constantly changing market conditions, every single hotel needs to understand the value of adequate proactive daily Revenue Management.

The main goal of Revenue Management is: to sell the right product to the right customer at the right time and for the right price, with an ultimate goal to maximize the bottom line (the final profit). How to find that right price and the right moment? Read further…

Main indexes used in the Revenue Management science

This is from the first grade of the hotel management class but still, let’s review them:

- Occupancy

Percentage of all rental units in the hotel that are occupied at a given time.

Calculated as: Number of occupied rooms/ Number of total available rooms, and expressed as a percentage.

- ADR (average daily rate)

Calculated as: Room revenue/ Number of rooms sold, and expressed in monetary units.

Sometimes a hotel’s productivity is evaluated based on one of the indexes mentioned above (more often – occupancy). Unfortunately, this limited analysis doesn’t reflect the complexity of the relationship between these two indexes, and the sales volumes they generate.

Revenue Management introduced a more accurate coefficient of measurement – RevPAR, which combines the two: occupancy and ADR in one statistic:

- RevPAR (revenue per available room)

Revenue per available room is often used to measure hotel’s productivity and also to compare different properties within a market.

It can be calculated in a few different ways:

= ADR x Occupancy

= Total guest room revenue/ Number of total available rooms/ Number of days in the period

RevPAR allows for obtaining a more accurate and broad picturing of hotel’s performance, and also compare the results with competitors in your market.

It is recommended that a hotel is signed up to receive monthly STAR reports by Smith Travel Research that display the property’s performance comparing to other hotels in the market.

Unfortunately, RevPAR is also not the most accurate index for measuring the effectiveness of your hotel’s Revenue Management activities, regardless of the widely spread opinion in the hotel industry. This statistic does not objectively reflect the performance (and profitability) of your hotel and particular Revenue Management techniques you implement, due to the following:

- It does not take CPOR into account (to be exact, variable costs per occupied room)

- And also doesn’t take into consideration any additional income a hotel may have from other revenue-generating departments (restaurants, meeting space, banquet rooms, casinos, parking, spa, etc.)

There is one more index, more accurate and objective:

- Adjusted RevPAR (AdjRevPAR)

More detailed description of this metric along with examples and calculations can be found in this article.

The hotel industry’s focus is finally shifting from high-volume bookings to high-profit bookings.

5 easy steps to successful Revenue Management

Now, let’s discuss the 5 basic steps to be performed in order to successfully manage revenue at a midscale or a limited service property. The steps are listed in order of importance (i.e. projected revenue potential). In your daily practice, start with 1 and proceed to the next as you become more comfortable with the routine.

STEP1: Dynamic pricing

Dynamic pricing IS really a big deal in Revenue Management. And every single hotel property needs to implement it. Here’s why.

As we know, effective Revenue Management requires a lot of forecasting. In order to be successful, it is necessary to be able to estimate approximate demand level for every day in the future, at least 365 days ahead, and price your hotel room accordingly.

However, setting your room rates for next year doesn’t mean that these rates should remain the same until that day arrives and the last guest is checked in. One of the biggest advantages of dynamic pricing concept is the ability to adjust to the real demand fluctuations, even if your initial forecast was inaccurate.

So how do I find the right price? The basic concept behind dynamic pricing in Revenue Management is simple: a hotel room should be priced based on supply and demand inter-correlations (equilibrium price).

And the key points to remember are the following:

- each day should be treated as a separate season

- prices need to be constantly re-adjusted in accordance with demand fluctuations in your market

In general, room rates should be increased when demand exceeds supply (in order to capitalize on ADR) and lowered when demand is weak (in order to increase occupancy). Proper pricing adjustments (daily or even hourly), which take existing demand into account and can even influence it, are the key to increased profitability. As was already mentioned, it is important to realize that the ultimate goal of any Revenue Manager should not be increasing occupancy, but rather maximizing the profit, the bottom line.

What’s also important is that managers’ pricing decisions have long-term effects. If you quickly sell a significant portion of your inventory at a low price, then of course, your occupancy index will increase. But another opportunity will be missed: that is, for example, to make more money on more profitable clients during the days that are closer to the arrival. And vice versa: holding your price too high, without paying attention to the competitors’ prices and a slowdown in the booking pace – will lead to a situation when a lot of inventory remains unsold. That makes dynamic pricing even more important in your daily hotel operations.

The two major mistakes that hotel managers make when pricing their rooms:

- pricing based on occupancy (for more details on why this approach is flawed, read this article)

- blindly following their competitors (for more details on this topic, read this article)

Instead, managers should react to the real demand fluctuations. Closely monitor your booking pace for the next 365 days to assess the strength of demand, or even better – implement an automated RM solution.

Example:

Let’s describe a situation when using Occupancy as an indicator for price adjustments can lead to incorrect revenue management decisions.

A manager is reviewing the upcoming Saturday in order to make a pricing decision. Currently, occupancy for that day is at 70%.

- Scenario 1: during the last 7 days occupancy for the weekend has been picking up at a steady pace, about 5% a day, with a jump of 10% since yesterday.

- Scenario 2: no reservations have been booked for the weekend during the last 7 days, and the hotel received 3 cancellations yesterday, thus the occupancy dropped from 73% to 70%.

We can see that in the 2 cases above, with the occupancy and the number of remaining days being equal, pricing decisions should be opposite. Scenario 1 describes high demand with strong pick up, which allows for a price increase since the current pickup pace indicates early sell out at the current price. Scenario 2 describes a situation when either the demand is weak or the hotel’s room rates are too high. Thus the most logical decision in this case would be to lower the rate to stay competitive.

Again, this confirms that occupancy alone cannot provide enough information for effective Revenue Management decisions. Price adjustments that are based only on occupancy while ignoring other parameters are in many cases incorrect and can lead to significant revenue and profit losses.

Instead, concentrate on your booking pace, which is an indicator of the demand strength. If you anticipate early sell out (demand exceeds supply) – increase the price. If the pace is too slow – lower the rate slightly and see how it affects your production. Constantly review and constantly re-adjust. Sounds like a daunting task but in reality, all you need is half an hour a day to grow your Revenue by 10-20 or even 30% and always be ahead of your competition, if implemented properly.

STEP 2: Setting stay restrictions

In addition to dynamic pricing fluctuations, there are a few other non-pricing methods of increasing revenue and profit. One method is setting stay restrictions and controls, which helps hotels maximize revenue potential through managing shoulder days. The 2 main restrictions used in the hotel industry are:

- Minimum length of stay (MLOS)

A restrictor that requires that a reservation is made only for at least a specified number of consecutive nights. It allows the hotel to develop a relatively even occupancy pattern during high demand periods or special events. It is intended to keep an occupancy peak on one day from reducing occupancy on shoulder dates. MLOS can also be applied with discount rates. For example, guest may have to pay Rack rates for shorter stays but be offered a discount for longer stays.

- Closed to arrival (CTA)

A restrictor that does not allow reservations with date of arrival at a specified date. This strategy is used in 2 cases: to limit the number of arrivals on a given day (to release the burden from the front desk, for example, in case of a large group arrival) and in conjunction with MLOS restriction, to achieve even occupancy during peak demand dates that are longer than 1 night. See examples below.

In general, stay restrictions allow hotels to filter less profitable clients during peak demand seasons, thus increasing the resulting room revenue. It is important to note that they should only be used when estimated sales flow is sufficient enough to reach high occupancy without the loss of revenue.

Example:

A 4-day conference that fills all hotel rooms in the city and nearby areas. You know for sure that your hotel will sell out, as the demand significantly exceeds supply. If you don’t set any stay restrictions, then 1 or 2 of these 4 days may fill up sooner than the others, thus leaving the shoulder dates unsold. The shoulder dates will be harder to sell, as they now become a product for a different target audience: not the convention attendee who comes to town for a 4-day event and is ready to pay a higher price but for a different buyer who is coming for 1 or 2 nights and has a lower price expectation. However, if stay restrictions are applied in advance, then all days in the chain will be sold evenly and at the same high price (assuming that you’re employing the correct pricing policy and accurately managing demand levels and your booking pace).This will allow for maximizing your revenue and profit.

Please note that in this example, CTA is set along with MLOS, as this is a multiple-night event. Setting only MLOS for all 4 days won’t prevent customers from checking in on any of the 4 days and thus won’t guarantee even occupancy throughout the whole event. In the case when there is only 1 day, for which the booking pace significantly exceeds the shoulder days, a 2 mlos restriction is most often used (i.e. on a Saturday night to assist with increasing occupancy for Friday and Sunday).

STEP 3: Managing booking channels

There are various booking channels, through which the property does its pricing distribution (direct bookings, walk-ins, online travel sites, travel agencies, opaque channels, corporate contracts, etc). The purpose of booking channel management is to maximize revenue through restricting some distribution channels with different profitability margins.

The concept:

Different distribution channels are configured into a small number of groups, each managed simultaneously as a whole. As in the case with stay restrictions: when estimated sales flow is sufficient enough to reach high occupancy without the loss of revenue (and profit), it may be beneficial to close less profitable channels in order to maximize the resulting yield. This will slow down the booking pace but will increase the resulting room revenue via the ADR growth.

How it works:

Booking channels are reflected in a hotel’s PMS through Rate Plans. Many of these rate plans are manageable (i.e. can be closed or open at a specific point in time for a specific date range). For effective Revenue Management, it is important to have a full list of all rate plans with corresponding margins and discounts off of Rack (BAR), then to group them into 3 or 4 categories based on their profitability level (or, their “proximity” to Rack rate). After that, manage these by closing the more expensive (and least profitable) channels based on the demand level and booking pace. Then sit back and watch your ADR go up during the high demand periods, which leads to the proportional increase of your profits.

Example:

Let’s imagine that a hotel has 6 different rate plans (this is obviously simplified for the sake of the example, as we know that in real life this number can go up to 20-30 or even 50 in many cases). The rate plans are: RACK, AAA (5% off Rack), AP (15% off Rack promo), OTA (20% off Rack), OPAQUE (30% off Rack), LASTMIN (35% off Rack). Looking at these rate codes, one can see that they’re not equal in the size of contribution to the bottom line profits. Let’s group them into 3 different categories, based on their profitability level (from the least expensive and most profitable channels to the most expensive and least profitable):

RACK, AAA – group #1

AP, OTA – group #2

OPAQUE, LASTMIN – group #3

When this exercise is done, then you start managing your channels by closing groups 3 and 2 for those dates where you can sell your rooms via channel group #1 alone, without having to offer deeper discounts. If your weekends always sell out, you may try to restrict #3 from booking those dates and see how this affects your occupancy and resulting ADR. For higher demand dates (special events) you can close groups #3 and #2 together. Group #1 always remains open.

There’s one thing to keep in mind. In some cases you may be unwilling to close a particular rate code, due to contracts with different companies that require Last Room Availability, or brand policies, etc. Place those in category #1, which is not closeable. Everything else should be divided among other categories and managed as described above.

STEP 4: Overselling

Overselling (or overbooking) is a technique used in Revenue Management to offset anticipated cancellations and no-shows . In other words, if you expect 2 cancellations and 1 no-show – you oversell by 3. That’s the optimal behavior that maximizes revenue. Sounds, pretty simple, right?

But nonetheless, it is still very common for most managers to close out availability on all channels before they reach 100% occupancy mark for a certain day. In most cases, this decision is dictated by the fear of dealing with walked guests.

However, correctly implemented overbooking practices will minimize the chance of a walk while leading to a noticeable increase in revenues (as well as profit).

Most popular mistake that leads to walks is picking the wrong time to overbook. As mentioned above, overbooking is designed to offset cancellations and no-shows.

Let’s ask ourselves: what is the main difference between those two occurrences? It is TIMING.

- cancellations can happen at any point in time, starting from 56 weeks before arrival (standard allowed lead time for transient bookings) until the end of the cancellation deadline

- no-shows always happen on the last day

Thus, we need to separate 2 different overbooking techniques: those that address cancellations and those that address no-shows. The latter is easy: calculate the anticipated number of no-shows (based on your historic data) and overbook on the last day by that amount of rooms. There are a number of good articles written on this subject (for example, “Overbooking ratio step-by-step” by eCornell).

But! What do we do with cancellations? There are articles explaining how to calculate average anticipated number of cancellations but no one tells you WHEN to do this, at what point in time (a small but a very important detail).

So here’s the key:

- It is not enough to just calculate the total number of rooms to oversell. You need to build a curve describing the forecasted number of potential cancellations at any point in time, for different number of days before arrival (see example below for explanations).

And another trick:

- Overselling needs to happen at the peak of demand, in order to maximize your revenue to its highest potential. This will ensure that:

- you sell those rooms at the highest possible price

- and (in many cases) you will still have plenty of time to wait for those precious cancellations (assuming the peak of demand for that day doesn’t fall on the last day before arrival, which in most cases it does not)

Obviously, we’re talking about high demand days only (when you expect to sell out) so there’s only that many days that you would need to review for your property. You can use an excel spreadsheet to build this graph (or a table), if you don’t have any automated Revenue Management tool that would help you do this.

Proper overselling at the peak of demand helps hoteliers sell their rooms at the premium rate and not leave money on the table from empty rooms due to anticipated cancellations and no-shows. For more details on overselling techniques described above, please read this article.

Example:

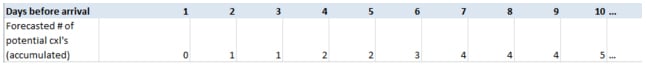

This is an example of how you can build a curve of forecasted number of cancellations related to the number of days before arrival. If you don’t have any automated Revenue Management tool that would help you with this, you can use a simple excel spreadsheet. The forecasted number of potential cancellations can be manually calculated as an average of actual cancellations from similar days in the past. So your table would look like this:

The example above shows 1 to 10 days before arrival but you should extend yours to at least the number of days that is equal to your average booking window. As you can see in this example, you shouldn’t worry if you find yourself overbooked by 5 rooms 10 days out. However, if you’re looking at tomorrow’s occupancy (1 day out), you should allow no more than 1 (unless you also anticipate no-shows).

STEP 5: Managing group and corporate business

By “managing group and corporate business” we don’t mean the actual sales activities to draw demand through these booking channels (that is the responsibility of your sales department). What we mean is assessing the profitability of these booking channels and managing them to maximize revenue and bottom line profit for your hotel.

Evaluation of group and corporate business is performed via the comparison of 2 alternatives, so called displacement analysis. The first alternative being the potential of revenue generation from a group request or a corporate contract (immediate revenues through rooms sold at a specific negotiated price plus expected additional revenues generated from other departments), and the second – revenue generated from expected sales of the same amount of rooms to transient business (potentially, at a higher price). The breakeven price to be quoted to a group or a corporate contract is found at the point where the potential revenues from these 2 alternatives are equal, which means that the hotel won’t be at a loss by accepting the contract.

In order to improve profitability of a hotel, sometimes it is necessary to limit (or decline) group business. Every group or corporate request needs to be revised as described above, in order to assess its revenue potential and displacement of the future transient business. To do that, the manager needs to have a relatively clear picture of the future demand expectations.

Keep in mind though, that in some cases managers need to look at the broader picture and accept an unprofitable request. For example, in order to maintain good relationship with a returning client. But in other cases, it may be much more beneficial to sell the same amount of rooms to future transient business for the following reasons:

- this booking channel doesn’t assume such deep discounts that are normally offered to groups (which means higher resulting ADR)

- you free yourself from the risk of a potential cancellation of a large number of rooms (this risk still exists , even if you set strict group cancellation rules)

Number of days in a calendar year, for which it may be more beneficial to decline a group request or set blackouts for a corporate contract, depends on the type of a hotel property, its location, mix of business, as well as the overall market dynamics.

Example:

As always, for the purpose of the exercise, this is a simplified example. Imagine a 100-room hotel. A group is looking to book 30 rooms for 2 nights on the 4

th

of July weekend, which historically has been a high demand season. The hotel is already 60% occupied and current Rack price is $229 a night.

Again, if you don’t have any automated tools to assist you with the displacement analysis, you need to calculate the breakeven price by comparing the potential total revenue generated by the group with the revenue flowing through the transient channel for the same amount of rooms. If you expect to sell all the remaining rooms at $229 Rack (minus commissions and discounts), then your resulting transient ADR maybe somewhere around $200.

Multiply that by the number of rooms and number of days: $200 x 30 x 2 = $12,000. This is your expected Total group value that would equally displace the transient business.

Then, subtract the expected revenues generated by other department that will be applicable to this group, like meeting space or FAB (in this example, let’s use a $1,000 meeting space fee, total for 2 days), to derive pure room revenue that needs to be achieved: $12,000 – $1,000 = $11,000.

Divide that by the total number of room nights to come up with the breakeven price to quote, per room night: $11,000 / 60 = $183.33

If the group’s asking price is much lower, than most likely you will be at a loss by accepting this business and turning away your transient customers.

Another thing to consider when quoting group rates is the wash factor. As we know, in most cases groups only end up picking up a portion of their block, so make sure to have proper cancellation/cutoff policies in place and take that into account in your displacement calculations.

Other tactics for increasing revenue

Managing online reviews

New York–based travel-research firm Phocuswright reported that people who read online hotel reviews are 59% more likely to book (source). TripAdvisor is the undisputed leader in the world of online travel reviews. However, it is also important to keep an eye (and respond to) the reviews posted on your own website (if you have this functionality), all major OTA sites, as well as social media resources.

There are SEO benefits, too. Adding original content to websites, such as reviews, is a great way of making your website visible.

Upgrading

Upgrading is an effective way of increasing revenues. Make an attempt to sell additional services or amenities at the front desk, on your website or via email marketing campaigns. A caller/booker may be unaware of varying rates and amenities. Employees must be trained to listen to guests and make suggestions for an appropriate accommodation. There are various methods of upgrading: top-down, rate-category-alternatives, bottom-up. There are also software tools that help hoteliers maximize their revenues through proper upselling. Here is an example of a good article on this topic: click here.

Managing room Type differentials

Watch the booking pace of different room types during different demand seasons and increase (or decrease) the difference between them to maximize resulting revenue.

For example, during the summer season, 2-bedroom suites may be more popular if the hotel attracts family business, vs corporate clients (single-bed users) during winter. Analyze your booking patterns per room type before making decisions on the room type differentials.

Managing ancillary revenues

Many hotels have other revenue-generating departments, in addition to rooms. If those revenues are significant, it is also important to manage them to maximize overall profitability of the hotel, which sometimes may mean discounting (or even eliminating) the charge of one department to increase the revenue from another one, thus increasing the overall bottom line. Example: offering free parking or a restaurant discount as an incentive for booking a large group.

All of the above (and more), nicely organized in 2 strategic blocks

Strong demand tactics (work hard, capitalize on ADR!)

- Increase Rack rate

- Apply stay restrictions (CTAs and mlos)

- Close or restrict discounted channels (analyze discounts and restrict them as necessary to maximize the average rate)

- Oversell by necessary amount at the peak of demand

- Reduce group room allocations

- Reduce or eliminate 6 P.M. holds (reduce or eliminate the number of unpaid rooms that are being held until 6 pm, if any)

- Tighten guarantee and cancellation policies

- Apply full price to suites and executive rooms

- Apply deposits and guarantees to the last night of stay (for longer lengths of stay, make sure the deposits and guarantees apply to the last night of the stay, minimizing early departures)

Weak demand tactics (work even harder, increase occupancy!)

- Sell value and benefits (rather than just quoting rates, make sure guests know you have the right product for them and the best value)

- Remove any stay restrictions

- Keep all discounted channels open

- Offer packages (to increase room nights, one tactic is to combine accommodations with a number of desirable products and services into a single package with one price)

- Remove any limits from group room allocations and release blackouts from corporate accounts

- Encourage upgrades (move guests to a better accommodation or class of service to enhance their experience and encourage them to come back to the property again)

- Involve your staff (create an incentive contest to increase occupancy and room nights)

- Lower your rates

Automation in Revenue Management

All individual tasks of Revenue Management described above can be performed manually. However, the most efficient way to handle data and generate profits is through Revenue Management Software (RMS). That’s why many hoteliers choose to employ specialized computer programs dedicated to Revenue Management automation.

Today, thanks to the great achievements in computer technology and computer networks, affordable automated Revenue Management has become available for low- and middle-tier hotels, small hotel chains and independent properties. Applying computer programs to Revenue Management in hotel business is now widely spread in the US and European markets.

Benefits of an automated Revenue Management System:

- The effectiveness of revenue management actions (and dynamic pricing in particular) is greatly increased with an RMS. Using an automated Revenue Management System can lead to 10-15% revenue increase in general (or higher in many cases).

- For hotels that spend their time on “manual” management, an RMS system will allow to optimize labor (lower payroll expenses) and

- eliminate significant errors in pricing decisions, especially in the conditions of economic instability.

- Such systems also allow managers to save time on routine analytical tasks and concentrate on more important strategic decisions.

All of the above, along with increased revenues (and profits) as well as stabilization of results, makes managers’ lives easier, increases their productivity and helps grow revenues more significantly.

Books

Books  E-Books

E-Books  Videos

Videos  Events

Events